Bitcoin faces some difficult questions ahead of the August 1st fork. Inefficiencies in the blockchain threaten to undermine the legitimacy and adoption of the world’s most popular cryptocurrency. While most agree that security should take precedent over ease of use, uncertainty in the technology could pose an existential threat to the surging new currency, and multiple competing solutions have been offered. Opinions on how to scale the capacity of the blockchain are split between the users ( the network of people who run Bitcoin ) and the miners, who run the code that powers Bitcoin on their computers. Both groups favor a Soft Fork or SegWit, but the miners propose additional requirements ( SegWit 2x) which could speed up the blockchain even further, but risks removing some of the decentralization that attracted so many people to Bitcoin in the first place.

In short, this is exactly the sort of complex, multivariable problem that Swarm Intelligence evolved to address. Previous swarms have offered insight into the 2016 Bitcoin Halving and others make weekly financial predictions for six major indices. But looking at the August 1st fork, current and potential investors Bitcoin have a dizzying amount of decisions to make. Much like the swarm of bees that must work together to find a location for their hive, a problem that no individual bee could wrap its head around, researchers at Unanimous AI convened a swarm of over thirty Bitcoin experts and enthusiasts to create the Swarm AI Guide to the Bitcoin Fork.

Perhaps the most pressing question for the Bitcoin Swarm AI is what current investors should do with their bitcoins ahead of the August 1st fork? Any change in the underlying technology presents a risk to Bitcoin investors, and some exchanges have gone so far as to announce wallet freezes. Analysts foresee both dips and surges in Bitcoin prices as the date approaches, but the Swarm AI was clear in its recommendation:

Typically, we’d turn now to Faction Analysis, our in-depth tools for analyzing the swarm’s insights. Faction Analysis is particularly useful when the answer has evolved over time, reflecting some conflict and tension in the swarm. But, in this case, the choice was so lopsided that the entire chart pointed to “Hold.”

Promises of another opportunity to buy in cheap like the July 14th drop to $1,800 are tempered by an equal number of predictions that Bitcoin will go on an early August tear, making it impossible for the swarm to recommend anyone try to time the market around the August 1st fork. Thus the Swarm AI’s recommendation mirrors some of the oldest advice given to those who want to invest in Bitcoin but are wary of its volatility, “buy one Bitcoin and forget about it.”

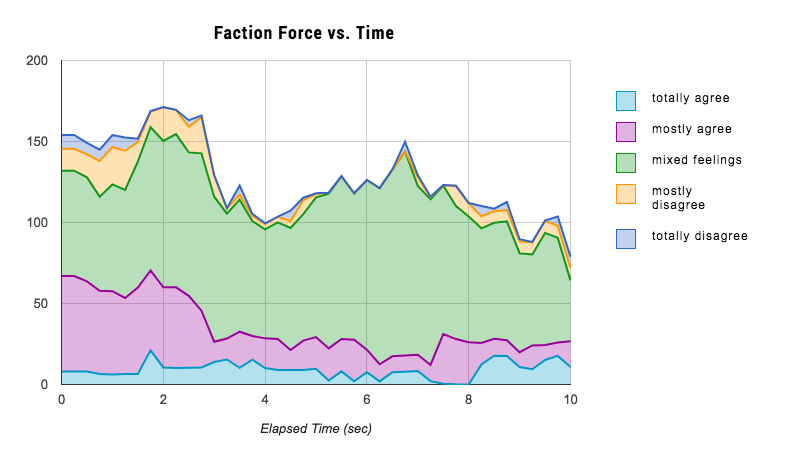

Still, even long term holders must be aware of the implications of SegWit 2x. Bitcoin can’t be considered a viable alternative to traditional currencies until it can be traded as quickly as they can, and the Soft Fork is the necessary result of the blockchain scaling problem. SegWit 2x is the miners’ proposed solution to the bottleneck, but in order to pay for the promised increases in efficiency, massive hardware upgrades that could drive some miners off the network are required. Confidence in the efficacy of SegWit 2x to solve the scaling problem would indicate that the past year’s worth of debate had reached a favorable conclusion, but the Bitcoin Swarm AI could muster only “mixed feelings” when asked if SegWit 2X would deliver on the miner’s promises.

The Faction Analysis for this question reveals a tension between two primary choices, “Mixed Feelings” and ‘Mostly Agree.” This seems to reinforce the notion that the idea SegWit 2x would be the fastest method for improving the efficiency of the blockchain, but the Swarm AI it unable to agree on it being the optimal choice. That doubt gains traction over the course of the answer until “Mixed Feelings” carries the day.

The rationale and motivation behind this thinking and more is revealed in the Swarm AI Guide to the Bitcoin Fork below. As you can see, the swarm is quite certain that the users should have more influence in a fork, but is resigned to the notion that the developers and miners pushing for their hardware and software combined solution will eventually win out. Further, you can see the Swarm AI’s wariness about the potential of Bitcoin Cash reflected in a recommendation that investors “Stay Away” and a belief that Bitcoin is the more likely currency to see widespread acceptance.

Finally, the Bitcoin Swarm AI leaves us with one final recommendation. Anyone itching to invest in cryptocurrencies this week might do well to avoid Bitcoin entirely and take a look at the competing cryptocurrencies. An expected slight dip in their value could present an opportunity to buy into those coins at a discount.

Every week Unanimous A. I. brings together swarms of regular people just like you to help us predict sporting events, investment opportunities, and technology as well as provide insight into everything from pop culture to politics. If you’d like information on joining a swarm – or just want to stay up to date on the latest predictions – click the button below.